Trademark Infringement - How to protect your original ideas and company ID

I recently shared a link to a New York Times article on a t-shirt company that was being very publicly “chastised” for creating and successfully marketing t-shirts with the text from some other gentleman’s twitter feed. Several clients have reached out to me since then wondering about their own trademarks and how to protect them. Every day, legally protected trademarks are used without authorization by a company's competitors and customers. The trademark owner has every right to want to protect their creative work.

Its important to protect your creative ideas and company identity by applying for and enforcing your trademarks.

Trademark infringement is a serious legal and business concern in today's marketplace. Brand names, logos, domain names, and slogans tied to successful businesses are now all on the internet and readily copied and used by others with a simple cut and paste. This not only causes confusion in the marketplace but also dilutes the distinctiveness of the mark and the program or merchandise that the mark represents.

Taking action to enforce trademark rights is now a cost of doing business, and it is required to maintain the integrity of the trademark and company that it represents. Trademarks receive legal protection primarily to prevent buyers from being confused about the source of goods or services. If a company that owns a trademark fails to control who uses the mark their underlying legal protection collapses. As a practical matter, the greater the use of the mark on related goods or services by persons other than the trademark owner, the less effective the mark becomes.

Creating and managing an enforcement program is vital to protecting these valuable intangible assets. The most obvious strategy is to send a C&D letter and, then if a satisfactory result is not obtained, resort to litigation.

A typical C&D letter will delineate the trademark owned; explain why the recipient is infringing on that right; and set forth legal claims for trademark infringement (such as: confusion in the marketplace, unfair competition, cybersquatting or dilution under federal and state laws). The letter concludes by requiring that the infringer send written assurances that the infringement will cease, under threat of further legal action.

The greatest advantage of sending C&D letters is that it can be a relatively low-cost way to resolve trademark infringements. Infringers often recognize that it is in their own best interest to stop the offending activity and cooperate with the trademark owner to resolve the matter amicably. When infringement is questionable, a C&D may be the first step toward negotiating an agreement that keeps the dispute out of court.

For cases that require actual litigation, the C&D is an important first step. The C&D establishes actual notice of the infringement claim and may give rise to a claim of intentional infringement if the activity continues after receipt of the letter. Courts often look to whether the parties attempted to resolve the matter before asking for judicial intervention, and the C&D letter is evidence of such an attempt.

Another way of dealing with a trademark issue may be to send some kind of modified C&D letter. In some cases, a less legalistic or formal communication may better address the situation and avoid hard feelings and negative public perception.

If the trademark infringement is not cut and dry, a C&D letter might not always be advised. The infringer might go to court first, and seek a declaratory judgment that it is not infringing on the rights of the trademark owner, and that the trademark set forth in the C&D letter is invalid or otherwise unenforceable. Thus, the goal of the C&D, to cost effectively stop the infringing activity, is thwarted.

Another concern to consider before sending a C&D is to make sure that the recipient of the letter does not have superior rights in the mark. Sometimes when two parties are using the same or similar trademarks, it is not obvious who has better rights. This is true particularly when neither party has a federal trademark registration that carries a presumption of validity as to ownership of rights. In such a case, common law trademark rights must be analyzed to determine who has a priority of use. It is vital to avoid sending a C&D until these issues are sorted out to avoid the recipient of a C&D letter replying with proof of a better right to the mark.

If you would like more information in either applying for a trademark registration or enforcing your ideas or company identity give me a call or shoot me an email.

How to protect your personal assets from your business liability - five keys.

Five key steps to keep your business separate and protect you personally.

If your business has its legal planning in place – your personal assets will most likely be protected from any liability that might occur as a result of your business operations. Following the five key guidelines below will help to create and maintain your business as a separate entity- protecting your family, home, and other personal assets from being “up for grabs“ should someone sue your business.

A properly formed business in Colorado is legally created and regulated by state laws and thus legally separate from the individuals who own them. To retain this separation, certain legal requirements and formalities regarding the maintenance and operation of the business must be followed. If these requirements are not met, the separation may be disregarded, with disastrous consequences.

The following is a brief summary of some of the benefits of having a properly formed legal entity for your business, no matter how large or small it is:

- Protection of Limited Liability: If you treat your business as an entity, separate from yourself, it is highly unlikely that the business entity will be disregarded by a court or government agency like the IRS. If it were disregarded, the result could be financially devastating. If the business entity cannot pay its debts, whether from regular operations or from liability attaching as a result of lawsuit or government action, your personal assets would be made available to the creditors of the business entity.

- Continual / Perpetual Existence: If businesses are properly planned for the death or disability of the owner does not mean that the business is dissolved (in the case of death) or unable to conduct business (in the case of disability). Changes in ownership and management are specifically addressed in the by-laws of corporations, in the operating agreements of LLCs, and in the partnership agreements of LPs.

- Access to capital: A business entity is a more attractive vehicle for investors than a sole proprietorship. Private investors are able to invest in business entities with confidence. This confidence comes from being able to invest and receive either a debt obligation (which may be convertible into equity under certain circumstances) or a portion of the ownership of the entity.

- Potential tax benefits: The owners of corporations and LLCs taxed as corporations may be able to receive tax benefits by sheltering business income in the entity—thus reducing the owners’ overall tax liability.

- Commercial credibility: American consumers are more accustomed to purchasing goods and services from businesses than sole proprietors. This instant reputability is another leading reason individuals use a legally separate entity as the business vehicle of choice.

- Employee benefits: Under certain circumstances, the ability to offer more comprehensive and deductible fringe benefits may result from the use of a business entity.

THE CHALLENGE

All too often, the requirements of just keeping a small business running leave little time for the owner or owners to engage in corporate/LLC/LP “housekeeping” and “maintenance.” Without some level of diligence on the part of the owners, a gradual merger of the life of the business and the life of one or more of the owners or managers may begin. When this happens, the separate legal status of the business entity begins to fade.

WHAT YOU NEED TO DO TO PROTECT YOURSELF AND YOUR BUSINESS

The following five key steps should be taken by all business entities, even those owned and managed by only one person.

1. Compliance with the Secretary of State:

As an initial matter, you should ensure that your business entity is in good standing at all times with the Colorado Secretary of State. You will receive an annual report from the Colorado Secretary of State each year (for entities other than Limited Partnerships). It is important that you complete and return this annual report with the required fee. Even if your entity is delinquent in annual filings or other matters, it is usually very easy to bring your entity into compliance with the Secretary of State. Typically, this will involve the filing of a delinquent annual statement or, possibly, reinstating your entity if it has been deemed dormant or inactive.

2. Internal Governance in Compliance with State Law:

It is important to keep your internal entity governance up to date. This step can not be over emphasized in its importance. Being in good standing with the Secretary of State is only the initial step in having your business entity recognized as separate from you (as the owner) at some future time whether in court or by a government agency.

3. Corporate Book

The most important action item is to ensure that your business document binder remains up to date. (This binder is universally referred to as the “Corporate Book” irrespective of whether you own a corporation, LLC or LP.) The binder should contain your entity’s organizing documents (articles of incorporation or articles of organization), the operating documents (by-laws, operating agreement, or partnership agreement), evidence of ownership (signed stock certificates, membership certificates, or partnership certificates), transfer ledgers, resolutions and agreements to extraordinary actions (opening bank accounts, signing a lease, making tax decisions, appointing officers, etc.), minutes of each annual meeting (discussed further below), tax documents (such as the Request for Employer Identification Number on Form SS-4 [the tax identification number for domestic business entities], S-Corporation Election on Form 2553, Tax Returns on the applicable forms [1065, 1120, 1120-S, etc.]), required permits and licenses for your type of business, leases, loan documents, and any other documentation that is evidence of your respect for the separation of the business entity from yourself.

4. Annual Meeting

Reviewing the actions of the entity and planning for any upcoming changes on an annual basis is important. The documentation of this annual review/meeting in the Corporate Book is one of the first items a future judge will review if ever asked to disregard your entity.

5. Keeping It Separate - Day to Day

You should also make sure the following tasks are accomplished and used in the daily running of your company:

- Open a bank account (usually a checking account) in the name of your entity.

- Ensure that you can document all moneys put into your entity in return for your ownership.

- In any interactions your entity has with other commercial enterprises or individuals, make certain that it is clear that you are acting on behalf of your entity and not as an individual.

- Use letterhead on all of your correspondence and contracts.

- Include the entity designation (“Inc.,” “Limited,” “Ltd.,” “LLC”) whenever possible on business identifiers such as business cards, advertisements, etc.

- Always sign documents in your representative capacity, and not as an individual:

YOUR ENTITY NAME

______________________________________________

by: YOUR NAME, YOUR TITLE (Manger, President, Owner, etc.)

- Ensure that all assets that are meant to be owned by your company are titled in the name of your entity and not in your name personally.

- Never commingle the funds or assets of your entity with your personal funds and assets. If you need to fund the operations of your company with your personal assets, document the transfer as either a loan or a contribution to the capital of your entity. If you need to use assets of the company for personal reasons, distribute the assets out of the company to yourself first as income, profit distributions, or a return of your capital contribution.

Framing Your Work: a Legal Plan for Artists and Healers

As a solo practitioner with 20 years of experience practicing law, I have been truly touched by the myriad of entrepreneurs that I have counseled in making their vision a reality. One area that I have particularly enjoyed is representing artists, healers, and other creative people in the legal aspects of their unique endeavors. Thus, allowing them to focus their time and energy on their creative work and not the legal framework necessary to protect and support it.

I represent, counsel, and advocate on behalf of the creative small business entrepreneur, artists, and practitioners in the healing modalities. It is an honor for me to represent, value, support and protect these creative independent artists and healers and the work they contribute so that they can focus on shining their bright light amongst us.

To this end, I believe that the law and legal problem solving methods are very powerful and I use these tools to empower my clients. This means making sure their contracts actually protect their interests and work. It means putting processes in place to make sure that they get paid on time and that their original ideas and work are protected. Staying ahead of the game by being properly informed is good planning. Legal planning is life planning.

What I actually can do for you if you are an artist or healer is to provide multi-faceted representation to facilitate your artistic work (whether it be painting or massage or some other unique form of expression). This may include but is certainly not limited to:

Establishing and helping to implement a new company – separating personal assets from business assets is a must.

Protecting original ideas through trademarks, copyrights, licensing agreements and enforcement efforts.

Advocating for your needs and priorities to help resolve disputes.

Negotiating and drafting contracts for artists, therapists, and other independent spirits so that you get paid for your work and your work is protected and only used with your consent.

Advising and providing guidance on laws and regulations that impact your work.

If you are an independent spirit and would like to discuss how I can help get your legal framework up and running give me a call to explore this further. I am happy to meet with you for a complimentary consultation.

Corporate Compliance

Whether you are operating as a Limited Liability Company or a Corporation in Colorado, it is important to keep your business in compliance with statutory requirements so that your personal assets are protected from any liability that your business might incur. Here is a checklist that will help you gauge whether your business is in compliance and if not what you might need to address.

- Filing with secretary of state. Colorado requires that all companies file an annual report. If you are not sure about the status of your company go to the secretary of state’s website and make sure you are in compliance with this requirement. http://www.sos.state.co.us/pubs/business/businessHome.html

- Operating agreement or bylaws. While Colorado does not require that an LLC have an operating agreement, the operating agreement is critical in terms of both company management and asset protection. Colorado does require that all Corporations have written bylaws.

- Company records. If your company is a corporation, Colorado requires that you keep the following items with your corporate records at your principal place of business:

- The Articles of Incorporation and bylaws

- Minutes from all director and shareholder meetings over the past three years

- All written communications to shareholders over the past three years

- A record of all actions taken by directors or shareholders without a meeting

- A record of all actions taken by a committee of the board of directors in place of a meeting

- A record of all waivers of notices of meetings of the shareholders, directors or any committee of the board of directors

- A record of the names and addresses of all shareholders, arranged alphabetically and by class of shares

- A list of the names and business addresses of current directors and officers

- A copy of the most recent annual report

- All financial statements for the past three years

- Separate bank account. Whether you are operating as an LLC or a corporation, you should keep a separate bank account for your entity and use it for all transactions. You should be able to document all moneys put into your entity in return for your ownership.

- Acting on behalf of the company. Any interactions you have in the course of doing business with other commercial enterprises or individuals should be clearly on behalf of the company and not as yourself individually. For instance, if I give a speech on estate planning I give the speech as Tanya Shimer of Tanya R. Shimer LLC and not just as myself individually.

- Written documents. Use letterhead on all of your correspondence and contracts.

- Entity designation. Always include the entity designation (“Inc.,” “Limited,” “Ltd.,” “LLC”) whenever possible on business identifiers such as business cards, advertisements, signs, etc.

- Your signature. Always sign documents in your representative capacity, and not as an individual:

YOUR ENTITY NAME

______________________________________________

by: YOUR NAME, YOUR TITLE (Manager, President, Owner, etc.)

- Titles of assets. Ensure that all assets that are owned by your company are titled in the name of your entity and not in your name personally.

- Keeping money separate. Be careful to never commingle the funds or assets of your entity with your personal funds and assets. If you need to fund the operations of your company with your personal assets, document the transfer as either a loan or a contribution to the capital of your entity. If you need to use assets of the company for personal reasons, distribute the assets out of the company to yourself first as income, profit distributions, or a return of your capital contribution.

- Annual meetings. Whether you are a corporation or an LLC, annual meetings are required This is one of the first things a judge will look for in deciding whether to allow a creditor or other to go after your personal assets.

- Corporate taxes and fees. Work with a professional to make sure that you are in compliance with all corporate taxes and fees and that your income tax returns are filed each year in compliance with both the IRS and the Colorado Department of Revenue.

While this checklist is not meant to be all inclusive its a good start and good self monitoring system for both you and your employees. I certainly hope that it helps! Don't hesitate to contact me if you have questions about your company and these guidelines.

LLCs and Taxation

Many of my clients are curious about forming LLCs and how they are treated for tax purposes. In Colorado, a limited liability company is considered to be a pass-through entity and is treated like a partnership or sole proprietorship for tax purposes. All of the profits and losses of the LLC pass through the business to the LLC members (owners) who then report this information on their personal tax returns. The LLC itself does not pay federal income taxes.

If the LLC is owned by a single member, the IRS treats it as a sole proprietorship for tax purposes. This means that the LLC itself does not pay taxes and does not have to file a return with the IRS. The sole owner of the LLC reports all profits or losses and submits it with his or her 1040 tax return. If the company makes a profit, even if the member leaves this money in the company, he or she must still report this and pay taxes on this money at the end of the year.

If the LLC is a multi-member LLC, the IRS treats it as a partnership for tax purposes. This means that multi-member LLCs do not pay taxes on business income. Instead, the LLC members each pay taxes on their share of the profits on their personal income tax returns. The LLC members’ share of profits and losses, called a distributive share (usually ownership percentage), should be set out in the LLC operating agreement.

Most operating agreements provide that a member's distributive share is in proportion to his or her percentage interest in the business. If the members decide to split up profits and losses in a way that is not in proportion to the members' percentage interests in the business, it's called a special allocation. The IRS has guidelines as to how this works.

The IRS treats each LLC member as though the member receives his or her entire distributive share each year. This means that each LLC member must pay taxes on his or her whole distributive share, whether or not the LLC actually distributes all (or any of) the money to the members. The practical significance of this is that even if LLC members need to leave profits in the LLC, each LLC member is liable for income tax on his or her rightful share of the profits left in the company.

As a result, if the members intend to keep a substantial amount of profits in the LLC (retained earnings), the members might benefit from electing corporate taxation. Any LLC can choose to be treated like a corporation for tax purposes by filing a form with the IRS within a certain time frame of the LLCs formation.

Rental Properties and Colorado LLCs

In Colorado, the Limited Liability Company business structure is popular because it is a hybrid of a corporation and a sole proprietorship/partnership, offering the benefits of both. For a rental property owner, an LLC provides many advantages and protections in legal, tax, and management flexibility. An LLC offers owners, also known as members, limited personal liability for liability created by the entity. One of the biggest benefits an LLC provides is personal property protection. An LLC maximizes asset protection, whether the rental owner has one or multiple properties. Each rental property should have its own LLC, so if the property owner gets sued, only the one property (LLC) will be liable instead of all of the investment properties and the personal assets of the owner. An LLC can be considered an alternate form of insurance because it protects the personal assets of a rental property owner from certain legal claims, such as slip-and-fall cases and contractual tenant disputes. Rental property owners must also be properly insured to protect the property from claims made directly against the LLC.

For tax purposes, an LLC must file a tax return as a sole proprietorship, partnership or corporation because the federal government does not recognize an LLC as a federal tax classification. One tax advantage of a single member LLC is the ability to use pass-through taxation. A single member LLC can choose to be taxed as a sole proprietorship. Income and capital gains from the LLC pass directly to the owner/member, avoiding double taxation. As the legal owner of the property, a single-member LLC can deduct mortgage interest based on IRS rules. An LLC can also choose to be taxed as a corporation. If an LLC has multiple members or opts to be taxed as a corporation, mortgage interest deductions and taxes become more complicated, so a consulting with a good CPA is helpful.

Once the LLC is set up, the owner/member is obligated to follow the guidelines spelled out in the operating agreement rather then the statutory obligations required of a corporation. Additionally, after the LLC is set up the member/members are required to file annually with the secretary of state, hold an annual meeting, keep a separate bank account, and not comingle funds.

If the rental property is mortgaged, retitling it into an LLC is an issue that will need to be addressed with the lender.

Clients who are successful entrepreneurs - some characteristics

What are the characteristics of successful entrepreneurs? I love representing clients who are starting a new business venture. It’s always exciting to hear about their vision and plans to implement it and I am always happy to walk them through the legal requirements of this process so that they have the proper structure and building blocks to make it happen. After fifteen plus years working with clients pursuing their dreams of creating a successful business venture, I have developed a sense of characteristics that are helpful to start and run a business.

1. Passion and Energy

My most successful clients are busy people; they possess the capacity to work long hours and don’t seem to ever tire of putting time into their business because they are passionate about creating and building it.

“You know you are on the road to success if you would do your job and not get paid for it.” – Oprah Winfrey

2. Ability to take Responsibility

My most successful entrepreneur clients take responsibility for their actions and decisions even in the face of failure. They don’t blame their employees or anyone else; instead they take charge, correct their business mistakes and move on.

“Sometimes when you innovate, you make mistakes. It’s best to admit them quickly and get on with improving your other innovations.” – Steve Jobs

3. Confidence

My most successful clients are confident in their ability and their vision to make it happen. Whatever their relationship is with trust and or faith, they also strongly believe in themselves and their ability to achieve their goals.

4. Persistence

“When the going gets tough, the tough gets going.” My most successful clients persevere without letting obstacles or unexpected failures slow them down – they reboot quickly and carry on.

“Nothing in the world can take the place of persistence. Nothing is more common than unsuccessful men with talent. The world is full with educated derelicts. Persistence and determination alone are omnipotent.” – Ray Kroc

5. Goal Setting

My most successful clients have the ability to set clear goals for themselves and continue to map out their achievements against these goals and set new goals as their business matures – some of my most successful clients set daily, weekly, monthly, and yearly goals. One question I always ask, even as we are just setting the legal structure in place to create the business is- how do you see this business in five years time?

6. Ability to take Risk

As we all know, business is a risk and to undertake it, you have to be daring. Successful entrepreneurs are risk takers; they gamble their time, energy and resources in pursuit of their vision and goals.

“You must take risks, both with your own money or with borrowed money. Risk taking is essential to business growth.” – J. Paul Getty

7. Intelligent Use of Feedback

My most successful client entrepreneurs take feedback seriously. They surround themselves with smart teams and solicit and listen to customer’s feedback – always seeking to improve.

“Sometimes, I think my most important job as a CEO is to listen for bad news. If you don’t act on it, your people will eventually stop bringing bad news to your attention and that is the beginning of the end.” – Bill Gates

8. Integrity

“It takes 20 years to build a reputation and only five Minutes to ruin it. If you think about that, you will do things differently.” – Warren Buffett

My most successful entrepreneurial clients have thought about and set out principles that they do not compromise. They hold themselves and their employees to these principles and they have usually integrated them into their company – and this integrity permeates their business - from their initial vision through to their back door (so to speak).

“Real integrity is doing the right thing, knowing that nobody’s going to know if you did it or not.” – Oprah Winfrey

- Intelligent Use of Resources

Sometimes, entrepreneurs are faced with the challenge of building a business with limited capital or other resources including personnel and space. When building a small business startup from scratch, there is a need for efficient use of limited resoures - and my most successful clients seem to thrive making things happen on a shoe string budget. Clients who track and manage their budget and other resources always seem to do well.

10. Treat People Well

My most successful clients are a joy to work with – their employees are happy to work for them and their customers are pleased with the service they receive from the company. – "Do onto others as you would have them do onto you ..." – actually works.

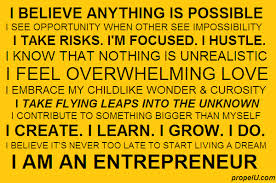

I saw this when I was looking for an illustration for this blog post and so thought to add it here - it is always a joy to work with my entrepreneurial clients - energizing and inspiring so - here is to you:

If you have questions about a business idea that you are exploring my initial consultations are complimentary - and its always good (easier ) to start off with a solid legal foundation - so don't hesitate to contact me for an appointment or teleconference. Click here for my complimentary Legal Guide to starting a business.

Important Documents Locator and Contacts

Clients always ask me how to store their estate planning documents and other important papers once their estate plan is done. I always recommend that they fill out the attached Important Document Locator and Contact Sheet as a part of this process so that family members and friends know who to contact and where to locate important records if necessary. I also recommend that they store their estate planning documents as follows:

Originals. Your original Will should be kept in a safe place, preferably in a fireproof safe or safe deposit box. Your original powers of attorney can be kept in your reference notebook. If you have revised or updated your documents, any old/former documents—including any copies—should be shredded.

Reference Set. If I did your estate plan, you have been provided with a reference set of your documents in an estate planning binder, creating complete set for your records. The copy of the will in this binder is not signed—you have only one valid, executed will, which you should keep pursuant to #1, above. If you decide to provide anyone with a copy of your will, be sure to copy the unsigned, reference will and not the original, signed will.

Copies for Agent. You should provide your agents with copies of your executed Powers of Attorney, both General and Medical. This will enable them to have the documents and act upon them without the necessity of obtaining copies once a disability or other unfortunate circumstance occurs. They should also be told about your complete estate planning binder (if you have one) and where it is located.

Copies for Physicians. You should also provide your physicians with copies of your executed Medical Power of Attorney and Living Will. They will then be able to keep these important documents in your files so that your agents will not have to search for them in the event of illness or accident.

Copies for Home. For clients living alone, especially aged clients, I recommend that copies of your Medical Powers and Living Will be kept in a readily accessible location such as your refrigerator or freezer in the kitchen, along with a note on the refrigerator door indicating that the documents may be found inside. First responders are taught to check the refrigerator door for important medical and pharmacological information. Finding the Medical Power of Attorney and Living Will along with other such information will make their treatment decisions easier, and better insure that your dignity is protected.

Fill out the Important Document Locator and Important Contact Information forms that follow. Keep them in a safe but obvious place such as the inside of a desk drawer or kitchen cabinet near the telephone. This will help your family members and friends in the event of an emergency and also might result in you feeling more organized and in control of your life!

Important Documents Locator and Contacts

DOCUMENT

LOCATION

NOTES

Durable Power of Attorney

Medical Power of Attorney

Original Last Will and/or Trust Documents

Living Will/MOST declaration

Property Deeds

CD Certificates

Personal Banking Accounts

Promissory Notes

Automobile Registrations

Birth, Marriage and Death Certificates

Medical Insurance

Passports

Retirement/Pension Accounts

Life Insurance Accounts

Credit Card Accounts

Stock and Bond Certificates

Long-term care insurance

Safety deposit box information/key

Internet accounts and passwords information

IMPORTANT CONTACTS

NAME

TELEPHONE NUMBER/EMAIL

Agent for health care power of attorney

Agent for general durable power of attorney

Person named as personal representative in will

Attorney

Accountant

Insurance Providers

HomeAutoLife InsuranceLong-term Care

Primary Care Physician

AdultsChildren

Personal friend/housesitterfamiliar with home

Veterinarian

Child care provider

Children’s school contact

Children’s local guardian

Children’s preferred babysitter

If you have a hard time printing these sheets I am happy to email you a copy either as a PDF or as a word document that you can customize to suit your needs. Just send me an email and let me know.

Are your personal assets protected from your business liability? Business Foundation Checklist

For the last six months I have been a part of a wonderful business- coaching group by Cheri Ruskus of the

Besides affording me the opportunity to learn and share with an amazing group of women entrepreneurs, I also have a new perspective and much better understanding on how to run my business from a business perspective rather then a lawyer's perspective. I am grateful and most pleased because I am sure that it will help me advise my clients better in running their businesses as well.Many of my clients own businesses and/or rental properties. I encourage them to meet with me on a yearly basis to review their business compliance and or landlord obligations - with the goal of making sure that their

personal assets

(such as their residence, savings, retirement, etc.) are protected should anything happen related to the business or rental property. If you don't have a proper business legally set up for either a business you are running or properties you are renting-- then your personal assets are at stake and up for grabs if your business or rental incurs liability. If you do have a proper legal foundation and your business is properly recognized, your personal assets will most likely be protected should something happen. I am always happy to meet with business owners and or property owners to review their business compliance needs and make sure their personal assets are protected. Check out the business compliance checklist below - for a quick self review.

Business success is not just about creativity and breaking through - its also about planning and having a solid legal foundation

Business Foundation Check List

Does your business follow these simple steps:

- Have you filed the appropriate documents with the secretary of state and if so are they kept up to date?

- Do you have a working operating agreement or bylaws for your company and is your company notebook current?

- Do you use a bank account (usually a checking account) in the name of your entity?

- Can you ensure that you can document all moneys put into your entity in return for your ownership.

- Is it clear that any interactions your entity has with other commercial enterprises or individuals that you are acting on behalf of your entity and not as an individual?

- Do you use letterhead on all of your correspondence and contracts?

- Do you include the entity designation ("Inc.," "Limited," "Ltd.," "LLC") whenever possible on business identifiers such as business cards, advertisements, etc.?

- Do you sign documents in your representative capacity, and not as an individual:

YOUR ENTITY NAME ______________________________________________

by: YOUR NAME, YOUR TITLE (Manager, President, Owner, etc.)

- Have you ensured that all assets that are meant to be owned by your company are titled in the name of your entity and not in your name personally.

- Are you careful to never commingle the funds or assets of your entity with your personal funds and assets. If you need to fund the operations of your company with your personal assets, document the transfer as either a loan or a contribution to the capital of your entity. If you need to use assets of the company for personal reasons, distribute the assets out of the company to yourself first as income, profit distributions, or a return of your capital contribution?

- Have you held your annual meetings - yes - annually?! This is one of the first things a judge will look for in deciding whether to allow a creditor or other to go after your personal assets.